It’s a great feeling when you accomplish something big at work. And it’s a great feeling when you do something that helps make the world a better place. Now’s your chance to do both at once.

One in two people will be directly affected by cancer in their lifetime. And heart disease, Australia’s number one killer, will take half of us – often far too soon. Finding medical answers to the diseases that impact our families takes time.

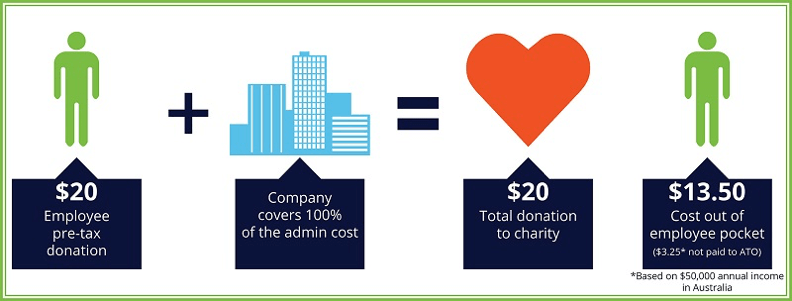

By joining your Workplace Giving program and making regular gifts from your salary to the Harry Perkins Institute of Medical Research, you’ll be supporting research into the hardest-to-treat-cancers, heart disease, diabetes and rare genetic disease. And you’ll be helping to keep families together for longer.